service tax credit card

For additional information see Notice 2009-89. Get Your Score for FreeNo Credit Card Needed.

Good And Service Tax Gst Concept With Finanical Elements Or Concept Of Online Payment Management Are Shown On The Background Of City Credit Card Ca Stock Vector Image Art Alamy

Your credit utilization ratio or how much of your credit limit you use makes up 30 of your credit score.

. How to Claim the Credit. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the. Here are some numbers to know before claiming the child tax credit or the credit for other dependents.

Best Tax Software. Finding the First and Second Economic Impact Payment Amounts to Calculate the 2020 Recovery Rebate Credit. Sure you could get your credit score somewhere else but you may have to pay.

If you didnt get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you dont usually file taxes - to claim it. Sure you could get your credit score somewhere else but you may have to pay. Must be an Indian resident.

Get your debt usage now. Best Tax Software Best Tax Software For The Self-Employed 2021-2022 Tax. Your credit utilization ratio or how much of your credit limit you use makes up 30 of your credit score.

Dont include personal or financial information like your National Insurance number or credit card. How you use credit affects your credit score. Getting access to your credit score isnt always easy.

To claim a general business credit you will first have to get the forms you need to claim your current year business credits. IRS will refund any overpayment unless you owe a debt on your account. The maximum amount of the child tax credit per qualifying child.

The total amount of the credit allowed for a vehicle is limited to 7500. You dont need to send in a voucher if you pay by card. Receiving the Credit on a 2020 tax return.

For 811 Dream different Credit card NRI Royale Signature Credit card the primary applicant should be in the age bracket of 18 years to 75 years. The Capital One SavorOne Cash Rewards credit card is designed for people who love earning rewards but dont want to pay annual fees. Card processing fees are tax deductible for business taxes.

Enjoy multiple credit card benefits like Cashback offers rewards points. Get a 25 Visa Prepaid Card by mail-in or online rebate 2 when you use the Volkswagen Service Credit Card on a qualifying purchase of 250 or more before tax. In addition to the credit form in most cases you may also need to file Form 3800.

For more information on the credit see our premium tax credit page our questions and answers and Publication 974. Note that the American Rescue Plan Act of 2021 enacted March 11 2021 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave for wages paid with respect to the period beginning April 1 2021 and ending. Users also get.

Allow 810 weeks for delivery of Visa Prepaid Card. Credit from Latin verb credit meaning one believes is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately thereby generating a debt but promises either to repay or return those resources or other materials of equal value at a later date. Middle navigation MENU NavBarAdvancedControlleruserNamesplit 0.

KNOW MORE KNOW MORE. 24-Hour Travel Assistance Service. Must be a salaried employee or self-employed With income proof Must meet the income requirement set by the bank.

Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund. If you file a Form 1040 or 1040-SR Schedule C you may be eligible to claim the Earned Income Tax Credit EITC.

The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. Getting access to your credit score isnt always easy. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring and employing individuals from certain targeted groups who have faced significant barriers to employment.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. The premium tax credit is refundable so taxpayers who have little or no income tax liability can still benefit. This special offer is available for a limited time only so apply today for this exclusive.

The credit begins to phase out for a manufacturers vehicles when at least 200000 qualifying vehicles have been sold for use in the United States determined on a cumulative basis for sales after December 31 2009. You can get access to your free credit score without a credit card or hard inquiry. In other words credit is a method.

Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score. For Estate Tax returns after 12311976 Line 4 of Form 706 United States Estate and Generation-Skipping Transfer Tax Return PDF lists the cumulative amount of adjusted taxable gifts within the meaning of IRC section 2503The computation of gift tax payable Line 7 of Form 706 uses the IRC section 2001c rate schedule in effect as of the date of the decedents death rather. The credit also can be paid in advance to a taxpayers insurance company to help cover the cost of premiums.

Use too much and your score goes down. Must be a resident of the serviceable locations within India. You can no longer use this service to renew your tax credits for the 2021 to 2022 tax year.

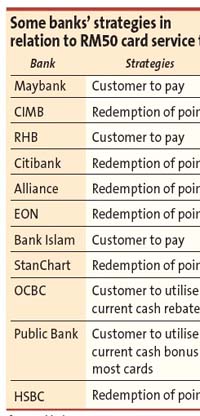

This free service includes a credit report card analysis and monthly score updates and monitoring. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Fuel surcharge of 25 plus service tax will be replaced by Convenience fee of 1 effective 01 Feb17 plus GST effective 01 Jul17.

How you use credit affects your credit score. Calculating the Credit for a 2020 tax return. Eligibility for claiming a Recovery Rebate Credit on a 2020 tax return.

Use too much and your score goes down. When you or a family member applies for Marketplace coverage the Marketplace will estimate the amount of the premium tax credit that you may be able to claim for the tax year using information you provide about your family composition projected household income and other factors such as whether those whom you are enrolling are eligible for other. These updated FAQs were released to the public in Fact Sheet 2022-16 PDF March 3 2022.

Claiming the 2020 Credit. You must contact the card processor to cancel a card payment. WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers.

Division O section 111 of PL. Get your debt usage now. Get Your Score for FreeNo Credit Card Needed.

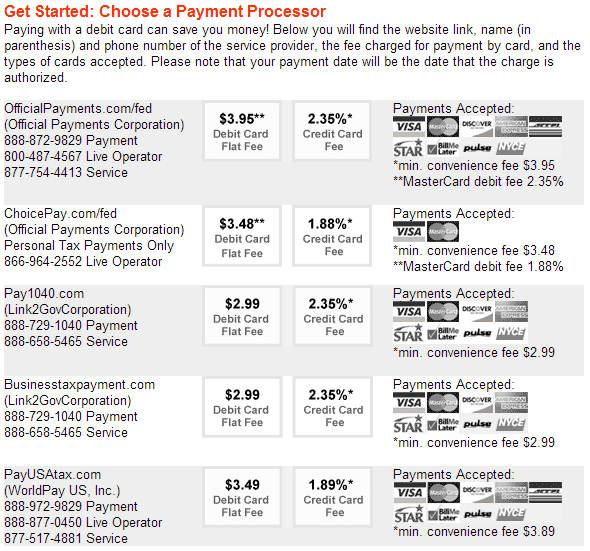

Apply for Credit Card Now. You can get access to your free credit score without a credit card or hard inquiry. No part of the card service fee goes to IRS.

What Are Features Of Credit Card

Online Tax Payment Service Taxation Tax Calculation Tax Form On The Monitor Documents Money Credit Card Invoice Stock Vector Illustration Of Internet Debt 212021552

Why Credit Card Tax Payments Are A Bad Idea Taxact

550 Credit Cards Ideas Personal Loans Loan Interest Rates Credit Card

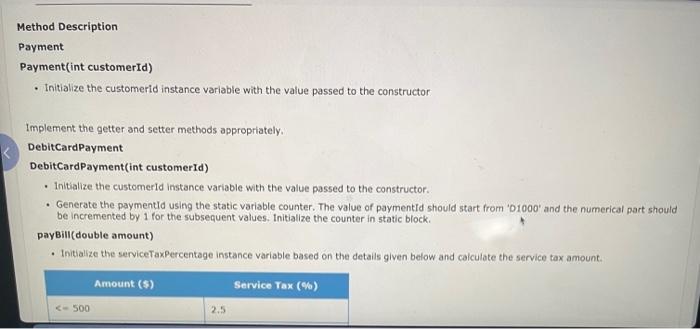

Solved An E Commerce Company Wants To Start A Payment Chegg Com

Best Buy Credit Card Rewards Financing

Government To Waive Service Tax On Debit Credit Card Transactions Up To Rs 2 000

Can Gst Be Paid By Using A Credit Card Iim Skills

![]()

Computer Icons Income Tax Service Tax Money Icon Text Investment Png Pngegg

Taxability Of Credit Card Cashback Rewards Calibre Cpa Group

Credit Card Holders Have To Pay Service Tax Or Use Points The Star

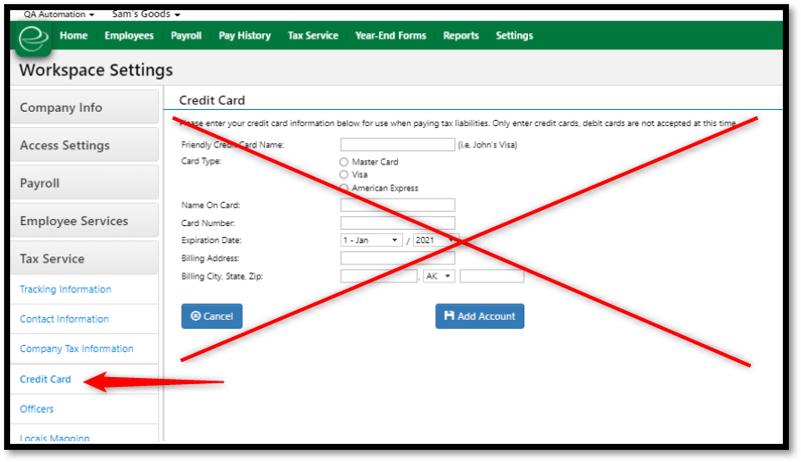

Release Notes Payroll Tax Service 6 1 2022 Greenshades

Taxpayer Advocate Internal Revenue Service

B H Payboo Credit Card Save Instantly Or Get Special Financing B H Photo

Wizi The Super App For Everything Credit Cards

Credit Cards Explained Credit Card Reviews News Analysis

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Paying Taxes With A Credit Card In 2022 Go Curry Cracker

197 007 Credit Cards Stock Vector Illustration And Royalty Free Credit Cards Clipart

Comments

Post a Comment